What to Do When the Stock Market Crashes

What to do when the stock market crashes is the biggest question every investor asks during sudden market falls. Panic selling, fear-driven decisions, and misinformation often cause more damage than the crash itself. History clearly shows that stock market crashes are temporary, but disciplined investing creates long-term wealth. Instead of reacting emotionally, investors should focus on proven strategies like staying invested, continuing SIPs, and buying fundamentally strong companies at lower valuations. Understanding how markets behave during crashes helps you protect capital, reduce losses, and position yourself for future growth.

If you’ve ever looked at your investments during a crash and thought:

“Should I sell everything?”

— you’re not alone.

The truth is: market crashes are not the problem.

Wrong reactions are.

First, Understand This Truth (Very Important)

Market crashes are temporary. Wealth creation is long-term.

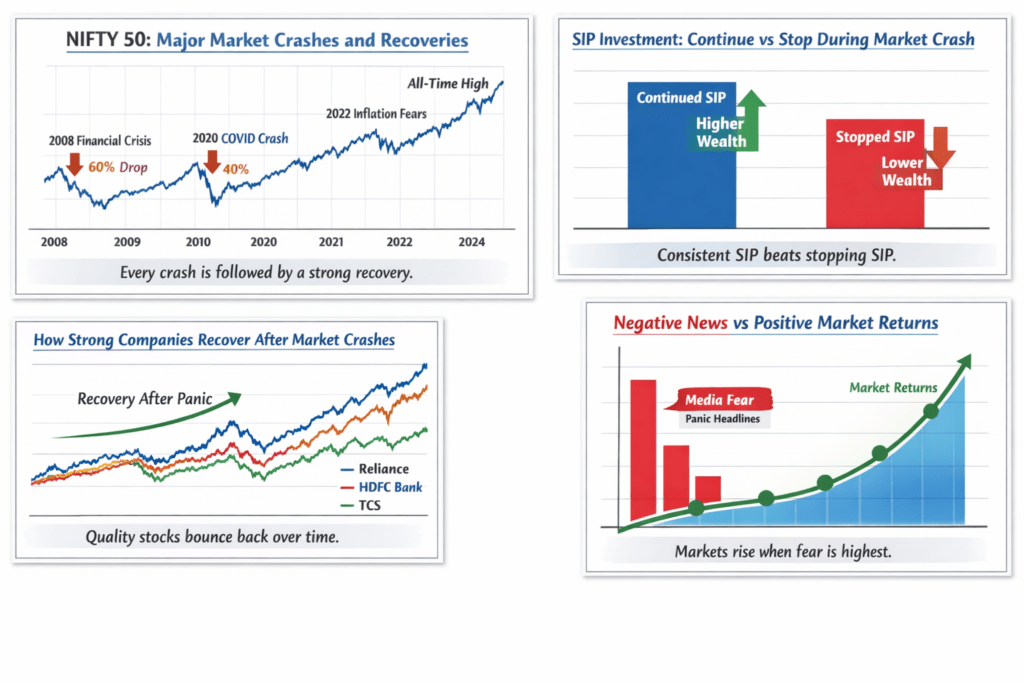

Every major crash in history felt like “the end” at that time:

- 2008 Global Financial Crisis

- 2020 COVID crash

- 2022 inflation & rate hikes

Yet the market recovered.

And investors who stayed calm came out stronger.

Step 1: Don’t Panic Sell (The Biggest Mistake)

When markets crash, your brain goes into survival mode.

You see:

- Portfolio down 20–40%

- News saying “worst fall ever”

- Friends saying “I sold everything”

And you feel the urge to sell.

Why panic selling is dangerous

- You book losses permanently

- You miss the recovery

- You sell when prices are cheapest

Selling in panic is like jumping out of a plane because of turbulence.

Turbulence feels dangerous, but planes are built for it.

Step 2: Remember Why You Invested

Ask yourself:

- Did I invest for long-term goals?

- Did the company’s business change, or only the price?

Price falls ≠ Business failure

A stock can fall because of:

- Fear

- Global news

- Interest rate hikes

- Temporary bad sentiment

But if the company is still:

- Profitable

- Growing revenue

- Low debt

- Strong management

Then the fall is an opportunity, not a disaster.

Charts Section: Stock Market Crash & Recovery

Step 3: Do NOT Check Your Portfolio Daily

During crashes:

- Daily checking increases fear

- Emotional decisions increase

- Stress affects your thinking

What smart investors do

- Check portfolio monthly, not daily

- Focus on business updates, not price

- Avoid TV debates and panic headlines

The less you watch the market, the better decisions you make.

Step 4: Continue SIP – Don’t Stop It

This is where most people fail.

What beginners do:

- Stop SIPs during crash

- Wait for “market to stabilize”

- Miss the best buying phase

What smart investors do:

- Continue SIP

- Buy more units at lower prices

- Benefit when market recovers

SIP works best during crashes, not bull markets.

Step 5: If You Have Cash, Use It Wisely

Crashes are not for gambling — they are for selective buying.

What you can do:

- Invest in strong large-cap stocks

- Add to quality mutual funds

- Buy index funds gradually

What you should NOT do:

- Go all-in at once

- Buy unknown small-cap stocks

- Follow tips and rumors

Buy quality, not quantity.

Step 6: Avoid These Common Crash-Time Mistakes

❌ Selling because others are selling

❌ Trying to “time the bottom”

❌ Switching strategies every week

❌ Borrowing money to invest

❌ Listening to WhatsApp stock tips

Crashes punish impatience, not intelligence.

Step 7: Learn From Past Stock Market Crashes

Let’s look at reality:

- Markets always recovered

- Companies survived

- Long-term investors won

Example:

An investor who stayed invested after 2008 crash saw massive wealth growth in the next decade.

Markets reward patience more than prediction.

Step 8: Focus on Asset Allocation

During crashes, balance matters.

Ideal approach:

- Equity for long-term growth

- Debt for stability

- Emergency fund for peace of mind

If equity falls, debt protects you from panic.

Step 9: Build or Strengthen Your Emergency Fund

Many people panic sell because they need money.

Solution:

- Keep 6–12 months of expenses aside

- Never invest emergency money in stocks

Emergency fund = emotional stability during crashes.

Step 10: Think Like a Business Owner, Not a Trader

Ask:

- Would I sell my business because profits dropped for one year?

- Or would I fix problems and wait?

Stocks represent ownership in businesses, not lottery tickets.

Step 11: How Crashes Create Millionaires

Most wealth is created:

- During crashes

- After crashes

- By people who stayed calm

Bull markets make you feel smart.

Crashes make you rich — if you handle them correctly.

Step 12: Simple Action Plan During a Market Crash

✔ Stay calm

✔ Continue SIP

✔ Avoid panic selling

✔ Buy quality gradually

✔ Ignore noise

✔ Think long term

Final Thought (Very Important)

The stock market transfers money from the impatient to the patient.

Crashes are painful, but they are also necessary.

They remove excess greed and reward discipline.

If you survive the crash emotionally,

financial success becomes inevitable.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Stock market investments are subject to market risks. Please consult a certified financial advisor before making investment decisions.

-

Should I sell my stocks when the market crashes?

No. Selling during a crash usually locks in losses. Historically, markets recover over time, and staying invested in quality stocks gives you a higher chance of recovery and growth.

-

Is a stock market crash a good time to invest?

Yes, for long-term investors. Crashes allow you to buy strong companies at discounted prices, which can significantly boost future returns.

-

What should beginners do during a market crash?

Beginners should avoid panic, continue SIPs, focus on learning, and invest only in fundamentally strong companies or diversified mutual funds.

-

Should I stop my SIP during a market crash?

No. Continuing SIPs during a crash helps you buy more units at lower prices, improving long-term returns through rupee cost averaging.

-

How long does it take for the stock market to recover after a crash?

Recovery time varies, but most major crashes in history have recovered within a few years. Long-term investors have always benefited from patience.

-

Are blue-chip stocks safe during market crashes?

Blue-chip stocks are generally more stable and recover faster than smaller companies because of strong fundamentals and market leadership.

-

How can I protect my portfolio during a market crash?

Diversify across asset classes, maintain an emergency fund, avoid over-leveraging, and invest with a long-term perspective.

-

Why does the media create panic during market crashes?

Negative news increases viewership. Media often focuses on short-term fear, while markets move based on long-term economic growth.

-

Can market crashes make investors rich?

Yes—investors who stay disciplined, invest consistently, and avoid emotional decisions often build significant wealth after crashes.

-

What is the biggest mistake investors make during a crash?

Panic selling. Emotional decisions during crashes destroy long-term wealth more than the crash itself.