Long-term stock investing is one of the most powerful ways to build wealth. But the real challenge is not investing—it is choosing the right stocks and holding them with discipline.

Many people enter the stock market with dreams of quick profits and exit with losses. This usually happens because they don’t understand how to evaluate stocks for the long term.

What Is Long-Term Stock Investment?

Long-term investing means buying shares of good companies and holding them for 5, 10, 15 years or more to benefit from:

- Business growth

- Compounding returns

- Dividends

- Market expansion

Long-term investors focus on the company, not daily price movement.

Why Long-Term Investing Beats Short-Term Trading

| Long-Term Investing | Short-Term Trading |

|---|---|

| Lower stress | High stress |

| Compounding works | No compounding |

| Lower taxes | Higher taxes |

| Requires patience | Requires constant monitoring |

| Suitable for beginners | Risky for beginners |

Legendary investor Warren Buffett became wealthy not by trading daily—but by holding great businesses for decades.

Step 1: Understand the Business First

Before buying any stock, ask one simple question:

Do I understand how this company makes money?

Ask Yourself:

- What product or service does the company sell?

- Who are its customers?

- Is demand likely to exist 10 years from now?

Example:

- IT companies: Demand for software will grow

- FMCG companies: People will always buy food & daily products

- Banks: Financial services are essential

If you don’t understand the business, don’t invest—no matter how attractive the stock looks.

Step 2: Look for Strong Fundamentals

Fundamentals show the financial health of a company.

Key Fundamental Factors to Check:

1️⃣ Revenue Growth

- Sales should grow consistently year after year

- Indicates increasing demand for products/services

Good sign: 10–15% consistent growth

Bad sign: Irregular or declining sales

2️⃣ Profit Growth

Revenue is useless without profit.

Check:

- Net Profit growth over 5–10 years

- Profit margins (Operating Margin, Net Margin)

A good company:

- Controls costs

- Improves efficiency

- Converts sales into profits

3️⃣ Return Ratios (Very Important)

These ratios show how efficiently a company uses money.

| Ratio | Ideal Value |

|---|---|

| ROE (Return on Equity) | Above 15% |

| ROCE (Return on Capital Employed) | Above 15% |

Higher ROE = better wealth creation potential.

Step 3: Check Debt Levels (Debt Can Kill Returns)

Too much debt is dangerous.

What to Check:

- Debt-to-Equity Ratio

- Interest Coverage Ratio

Ideal Debt-to-Equity:

- Less than 0.5 (for most companies)

High debt means:

- Higher interest burden

- Risk during economic slowdown

Many companies collapse not due to poor sales, but due to heavy debt.

Step 4: Consistent Cash Flow Is a Must

Profit on paper is not enough.

Check:

- Operating Cash Flow

- Free Cash Flow

A good company:

- Generates real cash

- Doesn’t rely only on loans

Cash flow is what keeps businesses alive during tough times.

Step 5: Competitive Advantage (Economic Moat)

An economic moat protects a company from competitors.

Types of Moats:

- Strong brand (HUL, TCS)

- High switching costs

- Government licenses

- Large distribution network

- Technology leadership

Companies with moats:

- Maintain profits longer

- Face less competition

- Grow steadily

Step 6: Quality Management Matters a Lot

A great business with bad management can fail.

How to Judge Management:

- Promoter holding (preferably above 40%)

- No major corporate governance issues

- Honest communication with shareholders

- Past performance consistency

Avoid companies with:

- Frequent fraud news

- Manipulated numbers

- Unclear business strategy

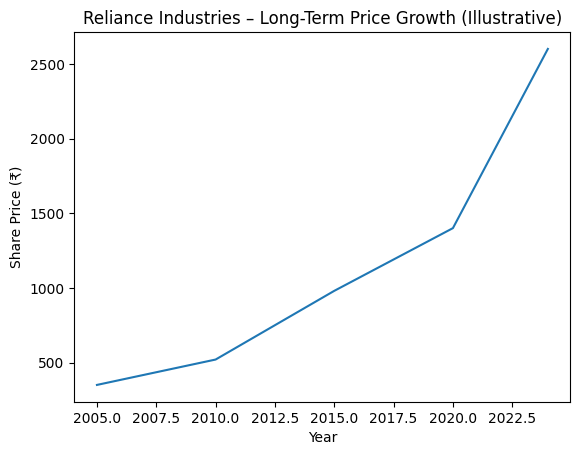

Chart 1: Reliance Industries – Long-Term Price Growth

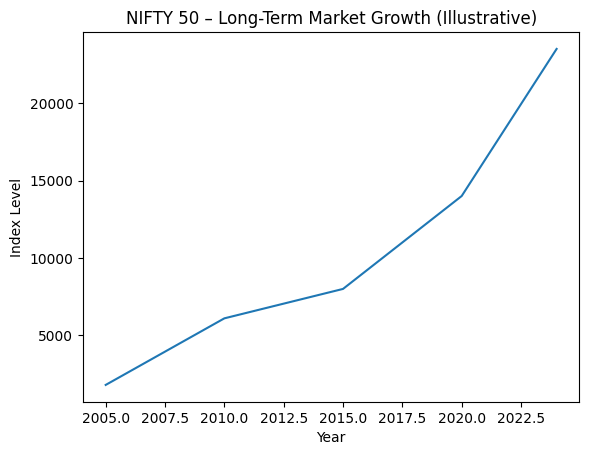

NIFTY 50 – Long-Term Market Growth

Step 7: Valuation – Don’t Overpay

Even a great company can be a bad investment if bought at the wrong price.

Important Valuation Metrics:

- P/E Ratio

- P/B Ratio

- PEG Ratio

Compare:

- Company vs industry average

- Company vs its own historical valuation

Buying a great company at a fair price is better than buying a poor company cheaply.

Step 8: Study Long-Term Growth Triggers

Ask:

- Will demand increase in the future?

- Is the company expanding?

- Is the industry growing?

Examples:

- Renewable energy

- Digital payments

- Healthcare

- Infrastructure

Long-term investors invest in future trends, not past glory.

Step 9: Diversify, But Don’t Over-Diversify

Diversification reduces risk.

Ideal Portfolio:

- 8–15 quality stocks

- Different sectors

Avoid:

- Putting all money in one stock

- Buying too many stocks (you can’t track them)

Step 10: Have Patience (The Biggest Secret)

The market rewards patience, not intelligence.

Short-term volatility is normal:

- Prices fall

- News creates panic

- Markets correct

But great companies recover and grow.

Time in the market is more important than timing the market.

Real-Life Style Example

Chandan – The Investor

- Invests in strong companies

- Studies fundamentals

- Holds stocks for 10 years

- Ignores daily noise

Result: Wealth grows steadily

Ganesh – The Impatient Trader

- Buys on tips

- Sells in panic

- Chases quick profits

Result: Emotional stress and losses

Common Mistakes to Avoid

❌ Buying stocks based on tips

❌ Panic selling during market falls

❌ Ignoring fundamentals

❌ Overtrading

❌ Investing without research

Best Tools to Research Stocks

- Annual Reports

- Company Investor Presentations

- Screener websites

- Stock exchange filings

- Business news (not rumors)

Final Thoughts

Choosing stocks for long-term investment is not difficult, but it requires:

- Discipline

- Patience

- Continuous learning

If you focus on quality businesses, buy them at reasonable valuations, and hold them long enough, wealth creation becomes inevitable.

Golden Rule of Long-Term Investing

Don’t look for the next hot stock. Look for businesses that will still be strong 10 years from now.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Stock market investments are subject to market risks. Consult a certified financial advisor before investing.

How do I choose the best stocks for long-term investment?

Choose companies with strong fundamentals, consistent profit growth, low debt, quality management, and a clear long-term business model.

What is the safest strategy for long-term stock investing?

The safest strategy is to invest in fundamentally strong companies, diversify across sectors, and stay invested for 5–10 years or more.

How many stocks should I hold for long-term wealth creation?

An ideal long-term portfolio should contain 8–15 quality stocks to balance risk and returns.

Is long-term investing better than trading for beginners?

Yes, long-term investing is less risky, requires less daily monitoring, and benefits from compounding, making it ideal for beginners.

How long should I hold stocks to get good returns?

To benefit from compounding, stocks should ideally be held for at least 5–10 years, or longer if the business remains strong.

Should I invest monthly or as a lump sum for long-term goals?

Monthly investing helps reduce market risk and emotional stress, while lump-sum investing works better during market corrections.

What financial ratios are important for long-term investing?

Key ratios include ROE, ROCE, debt-to-equity ratio, profit margin, and earnings growth.

Can I become rich through long-term stock investment?

Yes, consistent investing in quality stocks over long periods can create significant wealth due to compounding and business growth.

What mistakes should I avoid in long-term stock investing?

Avoid buying on tips, panic selling, overtrading, ignoring fundamentals, and investing without a clear strategy.

Is it safe to invest in stocks during market crashes

Yes, market crashes often provide opportunities to buy quality stocks at attractive valuations for long-term investors.