Introduction

One Market, Two Journeys in Trading vs Investing

The stock market is one of the most exciting places to grow your wealth. But for every person who enters, there’s a critical question:

“Should I trade, or should I invest?”

Many beginners see the glamour of trading: flashy screenshots of profits, influencers claiming instant success, and promises of “earn ₹5,000 a day”. Others read about investing quietly, seeing how small monthly contributions grow into life-changing sums over years.

Both Chandan and Ganesh had the same dream: financial freedom. Both started with ₹1,00,000 each, but three years later:

- Chandan sleeps peacefully every night, watching his wealth grow silently.

- Ganesh wakes up every morning, checking charts and losing sleep over market movements.

This is the story of mindset, strategy, and patience, not luck.

Trading: Fast, Exciting, but Risky

Trading is all about short-term profits. You buy and sell financial instruments — stocks, options, futures — based on market price movements. Trades can last:

- Minutes

- Hours

- Days

- Weeks

Types of Trading

- Intraday Trading: Buy and sell in a single day.

- Swing Trading: Hold for a few days to weeks.

- Futures & Options: Contract-based trades, high leverage, high risk.

Trading Requires

- Technical analysis (charts, indicators, patterns)

- Emotional control

- Quick decision-making

- Discipline and risk management

Trading is a business, not a shortcut. Most beginners underestimate how difficult it is.

Investing: Slow, Steady, and Powerful

Investing is long-term wealth creation. Money is put into assets like stocks, mutual funds, or ETFs, and left to grow over time.

Benefits of Investing

- Time works for you via compounding

- Risk is spread across diversified assets

- Minimal daily stress

- Wealth accumulates steadily over years

Ideal Investment Options for Middle-Class Indians

- Mutual Funds (SIP)

- Index Funds

- Blue-chip Stocks

- ETFs

Investing is boring for some, but the results speak for themselves.

Meet Chandan & Ganesh

Chandan: The Practical Planner

- Age: 28

- Profession: Private employee

- Monthly Income: ₹30,000

- Responsibilities: Family, bills, savings

- Market Knowledge: Beginner

- Time: Limited

Chandan’s goals:

- Financial security

- Stress-free wealth

- Retirement planning

Ganesh: The Risk-Taker

- Age: 25

- Profession: Freelancer

- Income: Irregular

- Responsibilities: Minimal

- Market Knowledge: Beginner

- Time: Flexible

Ganesh’s goals:

- Quick income

- Market excitement

- Fast wealth

Step 1: Understanding Risk & Mindset

Ganesh’s Initial Excitement

Ganesh saw trading as an adventure. He opened Instagram and YouTube and saw:

- “Earn ₹10,000/day trading!”

- Screenshots of profits

- Testimonials of “overnight success”

Ganesh thought:

“If others are earning this fast, why not me?”

He invested ₹1,00,000 into intraday trading, ignoring stop-loss rules, and believing in tips from Telegram groups.

Chandan’s Cautious Approach

Chandan decided he wanted long-term wealth, not adrenaline rushes. His approach:

- Monthly SIP of ₹5,000 in diversified equity mutual funds

- Ignore daily market fluctuations

- Focus on compounding over 15-20 years

“I don’t need to earn quickly. Time will work for me.”

Step 2: Real-Life Progress

Ganesh’s Journey

Month 1

- Profits: ₹2,000

- Confidence: High

Month 2

- Increased position size

- Ignored stop-loss

- Overconfidence

Month 3

- One major loss

- Revenge trading

- Capital dropped to ₹62,000

Ganesh realized:

“Trading is not just about money — it’s about controlling emotions.”

Chandan’s Journey

Chandan’s portfolio grew silently:

- SIP ₹5,000/month

- Annual return: 12%

- Time horizon: 20 years

| Investment Details | Amount |

|---|---|

| Monthly SIP | ₹5,000 |

| Duration | 20 years |

| Total Invested | ₹12,00,000 |

| Estimated Value @12% | ₹50,00,000 |

Chandan avoided the stress of daily trading and focused on consistent contributions.

Step 3: Psychological Difference

| Aspect | Trading | Investing |

|---|---|---|

| Stress | High, emotional rollercoaster | Low, long-term focus |

| Decision-making | Daily, fast | Quarterly/Monthly |

| Mindset | Risk-taker | Patient planner |

| Learning curve | Steep | Moderate |

Step 4: Why Retail Traders Lose Money

- Lack of preparation and education

- Overtrading and greed

- No risk management or stop-loss

- Emotional decisions

- Unrealistic expectations

Ganesh faced all these issues, while Chandan avoided them with simple rules.

Step 5: Can Trading Make Money?

Yes — but only with:

- Discipline and patience

- Risk capital (money you can afford to lose)

- Market knowledge and technical skills

Trading is like a full-time business, not a side-hustle for beginners.

Step 6: Investing Advantages

- Safe for middle-class Indians

- Works with limited time

- Less emotional stress

- Compounding leads to large wealth over decades

Step 7: Case Studies

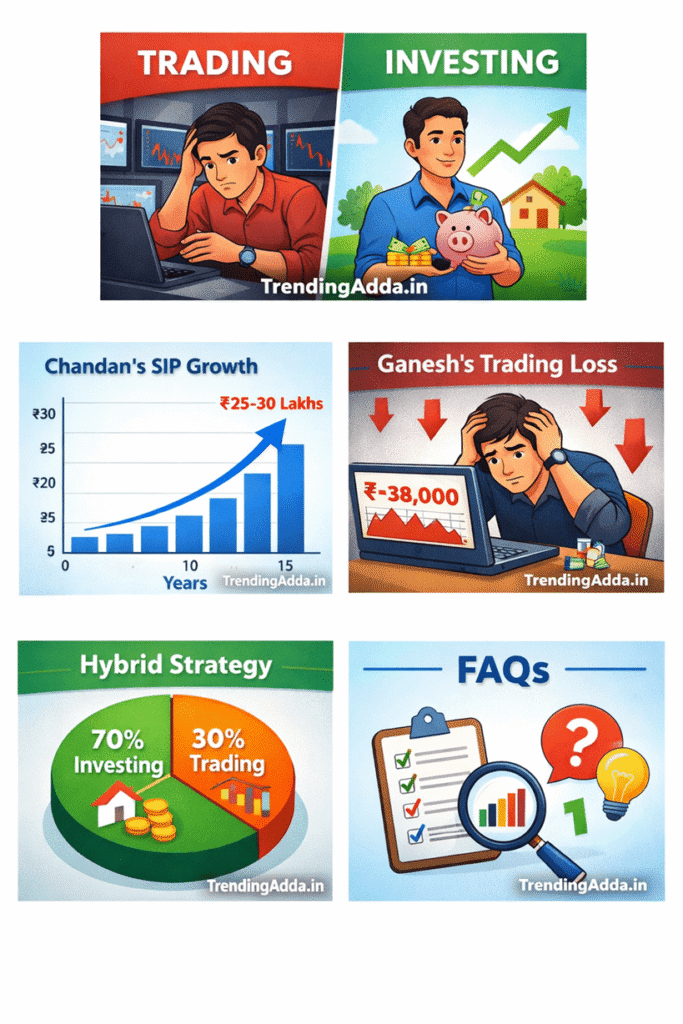

Chandan’s Case Study

- SIP: ₹5,000/month

- 20 years → ₹50 lakh portfolio

- Stress-free, predictable growth

- Portfolio diversified across 3-4 mutual funds

Ganesh’s Case Study

- Trading capital: ₹1,00,000

- Initial 3 months → loss of ₹38,000

- Learned technical analysis

- Now trades only 20% of capital, invests 80% in SIP

Step 8: Hybrid Strategy (Optional)

Ganesh eventually learned a hybrid approach works best:

- 80% of money: Long-term SIP investment

- 20% of money: Small trading portfolio

- Stop-loss rules and capital management strictly applied

This ensures wealth grows while still enjoying market excitement.

Step 9: Comparison Table

| Factor | Trading | Investing | Hybrid |

|---|---|---|---|

| Risk | High | Moderate | Moderate |

| Stress | High | Low | Medium |

| Skill Needed | Advanced | Basic | Moderate |

| Time Required | Daily | Minimal | Daily/Weekly |

| Returns | Short-term, unpredictable | Long-term, steady | Mixed |

Step 10: Key Takeaways

- Discipline beats desire

- Patience beats greed

- Consistency beats chasing excitement

- Emotions destroy wealth faster than markets

Chandan demonstrates the power of compounding.

Ganesh shows the risk of impatience and overconfidence.

Examples

Real-Life Indian Case Studies

Chandan’s SIP Journey

- Monthly SIP: ₹5,000

- Duration: 15 years

- Fund: Large-cap and index mutual funds

- Starting Capital: ₹5,000

- Final Portfolio Value (approx. 12% CAGR): ₹25–30 lakh

Lesson: Even small, consistent investments grow into significant wealth due to compounding.

Ganesh’s Trading Experience

- Initial Capital: ₹1,00,000

- Traded intraday using tips

- Ignored stop-losses → lost ₹38,000 in 3 months

- Learned technical analysis, risk management, and now trades only 20% of his capital

Lesson: Trading is like running a business — high risk, requires skill, patience, and emotional control.

Practical Tips for Beginners

For Trading

- Never risk more than 2% of capital in one trade

- Always use stop-loss

- Avoid chasing tips from social media

- Keep a trading journal

- Use only risk money, not savings

For Investing

- Start SIPs as soon as possible

- Diversify across large-cap, mid-cap, and debt funds

- Avoid reacting to short-term market news

- Review portfolio quarterly, not daily

- Stick to a long-term plan

Psychology of Money

- Fear & Greed: Ganesh’s losses were mostly due to emotional decisions

- Patience: Chandan ignored market noise and let compounding work

- Consistency: Small monthly investments beat occasional big wins

Rule of thumb: Wealth grows quietly; stress grows loudly.

Hybrid Approach for Middle-Class Indians

Many investors combine both:

- 70–80% in SIPs/mutual funds for long-term growth

- 20–30% in trading for learning and excitement

Why: You grow wealth steadily while experiencing market action safely.

Tools You Can Use

- SIP Calculator: Plan monthly contributions and expected wealth

- Trading Simulator: Practice trading without risking real money

- Portfolio Tracker: Keep track of investments and returns

Comparison Table (Expanded)

| Factor | Trading | Investing | Hybrid |

|---|---|---|---|

| Risk | High | Moderate | Medium |

| Stress | High | Low | Medium |

| Time | Daily | Minimal | Daily/Weekly |

| Skill | Advanced | Beginner-Friendly | Moderate |

| Returns | Short-term, volatile | Long-term, stable | Mix |

| Best For | Experienced, risk-takers | Middle-class salaried | Balanced approach |

Disclaimer

This content is for educational purposes only and should not be considered financial or investment advice. Stock market investments carry risks, and past performance does not guarantee future returns. Always consult a SEBI-registered financial advisor before making any investment decisions.

What is the difference between trading and investing?

Trading focuses on short-term price movements to make quick profits, while investing is about long-term wealth creation using assets like stocks, mutual funds, or ETFs. Trading requires daily attention and discipline; investing works with patience and compounding.

Which is better for beginners, trading or investing?

Investing is generally safer and more suitable for beginners. It requires minimal daily monitoring and helps build long-term wealth without the stress of daily market fluctuations.

Can trading make you rich quickly?

Trading can generate fast profits, but it comes with high risk. Most beginners lose money due to emotional decisions, overtrading, and lack of proper strategy.

How much time does trading vs investing require?

Trading requires several hours daily for market analysis and executing trades, while investing needs only periodic monitoring (monthly or quarterly).

Can I do both trading and investing at the same time?

Yes! Many people use a hybrid approach: allocate a small portion of capital for trading while keeping the majority invested long-term through SIPs or mutual funds.

What is the best approach for middle-class Indian investors?

Focus on long-term investing with SIPs, mutual funds, and index funds. Trading can be done with a small portion of risk capital, but the majority of wealth should grow steadily through disciplined investing.

How much money should I start investing or trading with?

Start investing with what you can comfortably set aside monthly (even ₹2,000–5,000). Trading should only be done with money you can afford to lose, as it is high-risk.

Can I start trading with small capital?

Yes, but expect limited returns. Risk management is crucial.

How long should I invest to see meaningful growth?

At least 10–15 years to take full advantage of compounding.

Should I stop SIPs during market crashes?

No. Market corrections are opportunities to buy more units at lower prices.

Can I rely on social media tips for trading?

No. Tips are often unreliable. Always research before acting.