Every parent wants financial security for their daughter. And when it comes to long-term savings, two options often come up:SIP vs Sukanya Samriddhi Yojana

- Investing through SIP (Systematic Investment Plan)

- Investing in Sukanya Samriddhi Yojana (SSY)

But the real question is:

Should you choose market growth or government guarantee?

What Is SIP?

SIP is a way of investing a fixed amount regularly in mutual funds, usually equity funds.

Instead of investing a lump sum, you invest monthly.

Example:

If you invest ₹5,000 per month in an equity mutual fund through SIP for 15–20 years, your money can grow significantly due to compounding and market growth.

Important:

SIP itself is not an investment. It is just a method of investing.

What Is Sukanya Samriddhi Yojana (SSY)?

Sukanya Samriddhi Yojana is a government-backed savings scheme for girl children.

- Available only for girls below 10 years

- Fixed interest rate (declared quarterly)

- Lock-in till maturity (21 years from account opening or marriage after 18)

It is considered safe and tax-efficient.

SIP vs Sukanya Yojana: Quick Comparison

| Feature | SIP (Equity Mutual Fund) | Sukanya Samriddhi Yojana |

|---|---|---|

| Risk | Market-linked (High) | Government-backed (Very Low) |

| Returns | 10%–14% (long-term average) | Fixed (around 8% approx., varies) |

| Liquidity | Flexible | Locked till maturity |

| Tax Benefit | ELSS only | Section 80C + tax-free maturity |

| Best For | Long-term wealth growth | Safe daughter-specific savings |

Returns Comparison

Let’s assume:

Scenario 1: SIP Investment

- ₹5,000 per month

- 15 years

- 12% annual return (long-term average equity)

Total invested: ₹9 lakh

Approx value: ₹25–27 lakh

Scenario 2: Sukanya Samriddhi

- ₹5,000 per month

- 15 years

- 8% fixed interest

Total invested: ₹9 lakh

Approx value: ₹16–17 lakh

Difference?

SIP potentially gives higher returns — but with volatility.

Risk Factor: The Biggest Difference

SIP

- Market ups and downs

- Temporary losses possible

- Needs patience

Sukanya

- No market risk

- Stable growth

- Fully secure

So this is not about “which is best.”

It is about risk appetite.

Liquidity and Flexibility

SIP

- You can stop anytime

- You can increase/decrease amount

- You can withdraw (depending on fund type)

Sukanya

- Money locked till 21 years

- Partial withdrawal allowed after 18 for education

- Strict rules

If flexibility matters, SIP wins.

If discipline matters, SSY wins.

Taxation Difference

SIP

- Equity funds taxed at LTCG (above ₹1 lakh gain)

- ELSS funds get 80C benefit

Sukanya

- EEE category (Exempt-Exempt-Exempt)

- Full tax-free maturity

Tax advantage strongly favors SSY.

Which Is Better for Girl Child?

If your goal is:

- Safe, guaranteed corpus → Sukanya

- Higher wealth creation → SIP

- Balanced approach → Combine both

Many smart parents do:

- Sukanya for safety

- SIP for growth

That creates stability + upside potential.

Real-Life Observation

In India, many parents prefer guaranteed schemes because market volatility scares them.

But those who started SIP 15–20 years ago for their children saw much larger wealth accumulation.

The truth?

Market rewards patience.

Final Verdict: SIP vs Sukanya Yojana

There is no universal winner.

Choose SIP if:

- You have long time horizon

- You understand market risk

- You want higher returns

Choose Sukanya if:

- You want guaranteed safety

- You prefer tax-free maturity

- You want discipline and security

Best solution?

Use both strategically.

SIP vs Sukanya Samriddhi Yojana – 20 Year Detailed Calculation

Let’s assume a practical example:

- Monthly Investment: ₹5,000

- Investment Period: 20 Years

- Total Monthly Contributions: 240

- Total Invested Amount: ₹12,00,000

Now let’s calculate both options realistically.

Scenario 1: SIP (Equity Mutual Fund)

Assumption:

- Average annual return: 12%

- Monthly compounding

Using standard SIP formula:

Future Value ≈ ₹49–50 lakh

Breakdown

- Total Invested: ₹12,00,000

- Estimated Value After 20 Years: ~₹49,95,000

- Wealth Created: ~₹37,95,000

This is the power of compounding over long periods.

But remember:

Returns are not fixed. Some years will be negative. Some years will be strong.

Scenario 2: Sukanya Samriddhi Yojana (SSY)

Assumption:

- Average interest rate: 8%

- Compounded annually

- Deposits made for 20 years (simplified comparison)

Future Value ≈ ₹29–30 lakh

Breakdown

- Total Invested: ₹12,00,000

- Estimated Value After 20 Years: ~₹29,60,000

- Wealth Created: ~₹17,60,000

This growth is steady and guaranteed by the government.

No volatility. No negative year.

Year-by-Year Growth Snapshot (Simplified)

| Year | SIP (12%) Approx | SSY (8%) Approx |

|---|---|---|

| 5 Years | ₹4.1 lakh | ₹3.6 lakh |

| 10 Years | ₹11.6 lakh | ₹9.2 lakh |

| 15 Years | ₹24.8 lakh | ₹17.3 lakh |

| 20 Years | ₹49.9 lakh | ₹29.6 lakh |

Notice something important:

The real difference happens in the last 5 years.

That is compounding accelerating.

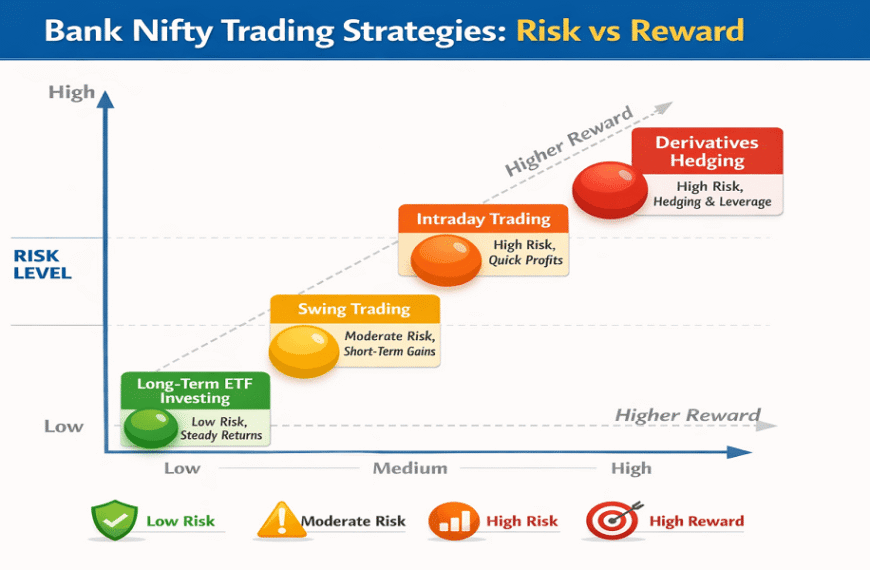

Risk vs Reward Over 20 Years

SIP

- Can fall 20–30% in bad years

- Requires patience

- Historically strong long-term wealth creator

Sukanya

- Stable

- Predictable

- Lower return ceiling

So over 20 years:

SIP potentially creates almost 1.6–1.7 times more wealth.

But only if you stay invested.

What If SIP Return Is Lower?

Let’s be conservative.

If SIP returns only 10% annually:

Final Value ≈ ₹38–39 lakh

Still higher than SSY.

If SIP averages 8% (same as SSY):

Then both will be similar.

So the deciding factor is:

Can equity beat 8% over 20 years?

Historically, yes.

Guaranteed? No.

Real-Life Interpretation

If your daughter is 2 years old:

You have long runway.

Equity volatility becomes less scary over 20 years.

If she is already 8–9 years old:

Shorter horizon.

Safety may matter more.

Smart Strategy Many Parents Use

Instead of choosing one:

- ₹3,000 in Sukanya (safe base)

- ₹2,000 in SIP (growth engine)

This creates:

- Stability

- Growth potential

- Diversification

Final 20-Year Summary

| Factor | SIP | Sukanya |

|---|---|---|

| Safety | Moderate | Very High |

| Return Potential | High | Moderate |

| Volatility | Yes | No |

| Liquidity | Flexible | Restricted |

| Best For | Wealth growth | Guaranteed corpus |

20-Year Example: Chandan vs Ganesh

Let’s imagine two friends:

- Chandan chooses SIP

- Ganesh chooses Sukanya Samriddhi Yojana

Both want to save for their daughter’s higher education after 20 years.

Both invest:

- ₹5,000 per month

- For 20 years

- Total investment: ₹12,00,000

Now let’s see what happens.

👨 Chandan’s Strategy – SIP in Equity Mutual Fund

Chandan believes in long-term market growth.

He starts a ₹5,000 monthly SIP in a diversified equity mutual fund.

Assumption:

- Average annual return: 12%

- Investment duration: 20 years

After 20 Years

- Total Invested: ₹12,00,000

- Estimated Final Value: ~₹49,95,000

- Total Wealth Created: ~₹37,95,000

But here’s the important part.

During these 20 years:

- Market crashed 2–3 times

- Some years gave negative returns

- Some years gave 20%+ returns

Chandan did one thing right:

He did not stop investing.

Because of compounding, the real growth came after year 12–13.

👨 Ganesh’s Strategy – Sukanya Samriddhi Yojana

Ganesh prefers safety.

He opens a Sukanya account for his daughter.

Assumption:

- Average interest rate: 8%

- 20-year deposit period

After 20 Years

- Total Invested: ₹12,00,000

- Estimated Final Value: ~₹29,60,000

- Wealth Created: ~₹17,60,000

No market tension.

No volatility.

No fear of loss.

Steady and guaranteed growth.

The Difference After 20 Years

| Factor | Chandan (SIP) | Ganesh (Sukanya) |

|---|---|---|

| Total Invested | ₹12 lakh | ₹12 lakh |

| Final Corpus | ~₹50 lakh | ~₹30 lakh |

| Wealth Difference | ₹20 lakh more | — |

| Risk Level | High | Very Low |

| Emotional Stress | Market ups & downs | Very stable |

Chandan potentially creates ₹20 lakh more wealth.

But only because:

- He tolerated volatility

- He stayed invested

- He trusted long-term compounding

What If Market Returns Only 10%?

If Chandan’s SIP averages 10% instead of 12%:

Final corpus ≈ ₹38–39 lakh

Still higher than Sukanya.

But if market performs poorly (8% average), then both may end up similar.

Emotional Reality

During a market crash:

Chandan might see:

₹25 lakh become ₹20 lakh temporarily.

Ganesh will never face this situation.

That psychological difference matters a lot.

So Who Is Smarter?

Truthfully?

Both are smart.

Chandan chose growth.

Ganesh chose certainty.

The real winner is the one who:

- Understands risk

- Stays disciplined

- Doesn’t panic

Balanced Strategy (What Many Parents Actually Do)

Instead of copying Chandan or Ganesh completely:

They split:

- ₹3,000 in Sukanya (safety base)

- ₹2,000 in SIP (growth booster)

This gives:

- Guaranteed minimum corpus

- Additional upside potential

Frequently Asked Questions (FAQs)

1️⃣ Is SIP better than Sukanya Yojana for a girl child?

It depends on your risk appetite. SIP offers higher long-term return potential because it invests in market-linked mutual funds. Sukanya Samriddhi Yojana provides government-backed safety with fixed interest. If you want growth, SIP may be better. If you want guaranteed safety, Sukanya is more suitable.

2️⃣ Can I invest in both SIP and Sukanya Yojana?

Yes, and many parents actually do this. Sukanya can act as a secure base for guaranteed savings, while SIP can provide growth potential. Combining both reduces overall risk and improves wealth-building chances.

3️⃣ What happens if the market crashes during SIP investment?

SIP investments may temporarily fall during market crashes. However, long-term investing (15–20 years) usually helps recover losses and benefit from compounding. The key is staying invested and not stopping during volatility.

4️⃣ Is Sukanya Samriddhi Yojana completely risk-free?

Sukanya is backed by the Government of India, which makes it very safe. However, the interest rate is revised quarterly. While returns are stable, they are not fixed permanently for 20 years.

5️⃣ Which option gives higher returns over 20 years?

Historically, equity SIPs have delivered higher long-term returns (10–14%) compared to Sukanya’s fixed rate (around 8%). But SIP returns are not guaranteed and depend on market performance.

6️⃣ Can I withdraw money early from Sukanya Yojana?

Partial withdrawal is allowed after the girl turns 18 for education purposes. Full maturity happens after 21 years from account opening. It is not as flexible as SIP.

7️⃣ Is SIP safer than Sukanya?

No. SIP is market-linked and carries risk. Sukanya is government-backed and safer. SIP offers higher growth potential but comes with volatility.

8️⃣ Which is better for education planning?

If your goal is guaranteed education funding, Sukanya provides stability. If you have a long time horizon and can handle market fluctuations, SIP may create a larger corpus.

9️⃣ Can SIP returns be lower than Sukanya?

Yes. If market returns average around 8% or lower over the long term, SIP returns may be similar to or lower than Sukanya. There is no guarantee.

🔟 What is the smartest strategy for parents?

A balanced approach often works best — invest part in Sukanya for safety and part in SIP for growth. This creates a combination of security and wealth creation.

Disclaimer

The information provided on TrendingAdda.in is for educational and informational purposes only and should not be considered financial, investment, tax, or legal advice. Investments in mutual funds, including SIPs, are subject to market risks and may experience volatility. Sukanya Samriddhi Yojana interest rates are determined by the Government of India and may change periodically.

Past performance of any investment does not guarantee future results. Return assumptions used in examples are for illustration purposes only and may not reflect actual market outcomes.

Readers should evaluate their financial goals, risk tolerance, and investment horizon carefully before making any decision. It is strongly recommended to consult a qualified financial advisor or certified investment professional before investing.

TrendingAdda.in does not promote or guarantee any specific financial product or return.