money with a low salary feels difficult, stressful, and sometimes even impossible. Many people silently believe that saving is only for those who earn big salaries. If you earn less, you are expected to just survive from one month to another.

But this belief is wrong.

Thousands of people with low salaries build strong savings, while many high earners live paycheck to paycheck. The difference is not income—the difference is mindset, habits, and planning.

This detailed guide is written in professional, easy-to-understand English, enriched with real-life examples, slogans, short quotes, and relatable situations, so that reading feels engaging and useful—not boring.

The Biggest Myth About Saving Money

“I will start saving once my salary increases.”

This is the most dangerous financial myth.

The truth is:

People who don’t save with a low salary rarely save with a higher salary.

Why? Because spending grows with income. This is called lifestyle inflation. If you don’t build the habit now, money will always feel insufficient.

A Hard but Honest Reality Check

Saving money is not an income problem. It is a behavior problem.

Let’s be honest.

- A low salary makes saving harder—but not impossible

- Lack of planning makes saving impossible—even with a high salary

If you change your habits, even a small income can support saving.

Real-Life Example: Rahul vs Aman (Extended Case Study)

Let’s understand this with a real-world situation.

Rahul

- Monthly salary: ₹18,000

- Lives in a shared room

- Eats home-cooked food

- Uses public transport

- Saves ₹1,500 every month

After 2 years:

- Emergency fund: ₹40,000+

- No credit card debt

- Less financial stress

Aman

- Monthly salary: ₹30,000

- Lives alone

- Orders food frequently

- Uses credit cards

- Buys gadgets on EMI

After 2 years:

- Emergency fund: ₹0

- Credit card dues

- Always worried about money

Higher income gives comfort. Better habits give security.

Step 1: Accept Your Salary and Take Control

The first step is acceptance—not complaint.

Complaining sounds like this:

- “My salary is too low”

- “Saving is not possible for me”

Control sounds like this:

- “What can I do with what I earn?”

You don’t need a perfect salary. You need a realistic plan.

Step 2: Low Salary Does Not Mean Zero Savings

If your salary is low, your savings target should be small—but consistent.

Saving ₹500 looks meaningless until you compare it with saving nothing.

Practical Saving Benchmarks

- ₹10,000–₹15,000 salary → Save ₹500–₹1,000

- ₹15,000–₹20,000 salary → Save ₹1,000–₹2,000

- ₹20,000–₹25,000 salary → Save ₹2,000–₹3,000

Consistency is more powerful than amount.

Step 3: Pay Yourself First (Non‑Negotiable Rule)

Most people follow this formula:

Income – Expenses = Savings ❌

Smart people follow:

Income – Savings = Expenses ✅

The moment your salary is credited:

- Transfer savings immediately

- Set auto-debit for SIP or RD

Money saved automatically is money saved permanently.

Step 4: Track Expenses for One Month (Eye‑Opening Exercise)

People often say:

“I don’t know where my money goes.”

That’s because they never track it.

Common Expense Leaks

- Tea & snacks daily

- Online food delivery

- Ride-hailing apps instead of public transport

- Unused subscriptions

Money doesn’t disappear. It escapes quietly.

Track expenses for 30 days—you will find saving opportunities yourself.

Step 5: Create a Simple Budget That Actually Works

You don’t need complex Excel sheets.

Low‑Salary Friendly Budget

- 70% – Needs (rent, food, travel)

- 20% – Wants

- 10% – Savings

If 10% feels difficult, start with 5%.

Starting small is better than planning big and doing nothing.

Step 6: Cut Small Expenses Without Killing Joy

Saving doesn’t mean living a boring life.

Smart Cuts (Not Sacrifices)

- Reduce food delivery from 10 times to 3 times

- Cancel unused subscriptions

- Carry water & snacks

You don’t need to stop enjoying life—just stop overpaying for it.

Step 7: Emergency Fund – Your Financial Shield

An emergency fund protects you from:

- Medical emergencies

- Job loss

- Family responsibilities

Without it, people depend on loans.

Loans solve today’s problem and create tomorrow’s stress.

Emergency Fund Plan

- First target: ₹10,000

- Second target: 1 month’s expenses

- Final target: 3–6 months’ expenses

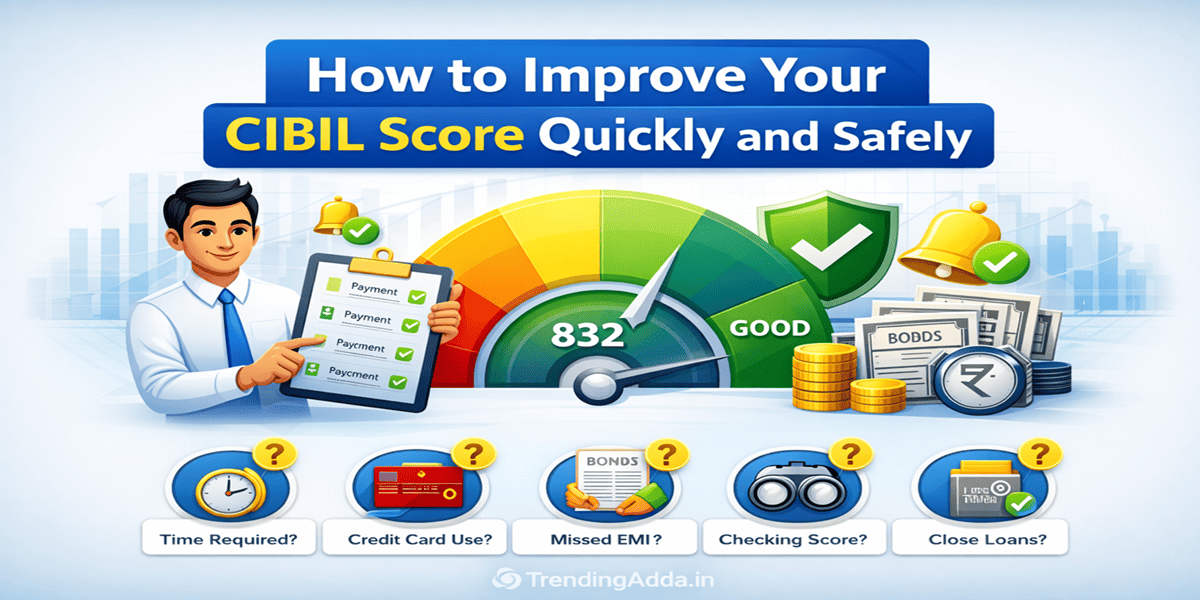

Step 8: Can You Invest with a Low Salary?

Yes—if you start small.

Beginner‑Friendly Options

- ₹500 SIP in mutual funds

- Recurring Deposit (RD)

Wealth is built slowly, not suddenly.

Start small. Stay consistent.

Step 9: Avoid the EMI Lifestyle Trap

Low salary + EMIs = permanent pressure.

EMIs are like guests who stay even after your salary is gone.

Avoid unnecessary EMIs for:

- Mobile phones

- Fashion

- Online shopping

Step 10: Increase Income Along with Saving

Saving has limits. Income growth doesn’t.

Simple Ways to Increase Income

- Learn high-demand skills

- Freelance part-time

- Switch jobs strategically

Saving helps you survive. Income growth helps you grow.

Common Mistakes Low Salary Earners Make

- Waiting for a higher salary

- Not tracking expenses

- Misusing credit cards

- Comparing lifestyle with others

Comparison is the fastest way to kill savings.

Powerful Money Slogans to Remember

- Low salary, smart planning, safe future

- Save first, spend later

- Habits matter more than income

- Salary may be small, mindset shouldn’t be

Step 11: Psychology of Saving – Why Our Brain Resists Saving

Many people fail to save not because of income, but because of psychology.

The human brain prefers instant pleasure over long-term benefit. Buying food online, upgrading a phone, or shopping during sales gives immediate happiness. Saving money gives no instant reward, which makes it difficult.

Your brain loves spending today. Your future loves saving today.

How to Hack Your Brain

- Automate savings so you don’t think about it

- Keep savings account separate

- Avoid checking investment apps daily

Saving becomes easier when emotions are removed.

Step 12: The Role of Lifestyle Choices in Low Salary Savings

Lifestyle is not about luxury. It is about daily decisions.

Two people earning the same salary can live very different financial lives.

Smart Lifestyle Choices

- Shared accommodation instead of solo rent

- Cooking at home instead of daily ordering

- Public transport over cabs

A simple lifestyle today buys freedom tomorrow.

Step 13: How Small Habits Create Big Savings Over Time

Saving is not a one-time action. It is a daily habit.

Example of Habit Power

- Saving ₹50 daily = ₹18,250/year

- Saving ₹100 daily = ₹36,500/year

Small drops make a powerful ocean.

Don’t underestimate small amounts.

Step 14: Saving Challenges You Can Try

Gamifying savings makes it interesting.

Simple Challenges

- No-spend Sunday

- 30-day expense tracking challenge

- Save all ₹10 coins challenge

Saving doesn’t have to feel like punishment.

Step 15: How to Save Money While Supporting Family

Many low-salary earners support parents or siblings.

This makes saving harder—but not impossible.

Smart Approach

- Fix a monthly family support amount

- Keep personal savings separate

- Avoid guilt-driven spending

Helping family is responsibility, not a reason to destroy your future.

Step 16: Credit Cards – Friend or Enemy?

For low salary earners, credit cards are risky.

Used wisely:

- Build credit score

- Handle emergencies

Used poorly:

- High interest debt

- Monthly stress

If you can’t pay full bill, don’t swipe the card.

Step 17: What to Do When You Fail to Save One Month

Missing savings once is not failure.

Giving up completely is.

Recovery Strategy

- Don’t compensate by borrowing

- Restart next month

- Review what went wrong

Consistency beats perfection.

Step 18: Long-Term Vision – Why Saving Changes Your Life

Saving gives you:

- Confidence

- Peace of mind

- Freedom to make choices

Without savings:

- Every problem feels like a crisis

Money saved today buys options tomorrow.

Step 19: Inspiring Real-Life Indian Examples

Case 1: Delivery Executive

Saved ₹1,000 monthly for 3 years → ₹40,000+ emergency fund

Case 2: Office Assistant

Started ₹500 SIP → ₹1.2 lakh in 5 years

Ordinary people. Extraordinary discipline.

Step 20: Final Checklist for Low Salary Savers

- Start small

- Save first

- Track expenses

- Avoid unnecessary EMIs

- Increase income gradually

You don’t need motivation. You need a system.

Final Thoughts

A low salary is a challenge—not an excuse.

Start with ₹500. Build discipline. Stay consistent.

People don’t stay poor because they earn less. They stay poor because they never start.

Take one small action today.

Your future self will thank you.

Can I really save money with a low salary?

Yes. Saving depends more on habits and planning than income. Even saving ₹500–₹1,000 monthly builds discipline and financial security over time.

How much should I save if my salary is low?

Start with 5–10% of your monthly income. If that feels difficult, begin with a fixed amount like ₹500 and increase gradually.

Is saving better than investing for low salary earners?

Saving comes first. Build an emergency fund before investing. Once stable, start small investments like ₹500 SIPs.

What is the biggest mistake low salary earners make?

Waiting for a higher salary to start saving. Delaying savings is the biggest financial mistake.

Should I avoid EMIs if my salary is low?

Yes, unnecessary EMIs increase financial stress. Avoid EMIs for lifestyle expenses and focus on saving first.

Disclaimer

The information provided on TrendingAdda.in is for educational and informational purposes only. All content related to personal finance, saving money, budgeting, investments, mutual funds, SIPs, stock market, loans, and financial planning is based on general research and personal understanding.

We are not registered financial advisors, and the content published on this website should not be considered financial, investment, legal, or professional advice.

Before making any financial decision, readers are strongly advised to do their own research and consult a certified financial advisor or professional if required.

TrendingAdda.in will not be responsible for any financial loss, risk, or damage arising directly or indirectly from the use of information available on this website. Financial decisions involve risk, and past performance does not guarantee future results.

Table of Contents

Disclaimer: This article is for informational purposes only and should not be treated as financial advice. Please consult a qualified financial advisor before making any financial decisions.