If you have ever felt confused between stocks, mutual funds, SIPs, and index Investments, you are not alone. Many investors want market returns but don’t want the stress of picking individual stocks or paying high mutual fund fees. This is exactly where ETFs quietly shine.

ETFs are not new, but they are still misunderstood by many retail investors in India. The truth is, ETFs are one of the cleanest, cheapest, and most disciplined ways to participate in long-term wealth creation.

What Exactly Is an ETF?

An ETF (Exchange Traded Fund) is a fund that simply follows a market index, sector, commodity, or asset and trades on the stock exchange like a normal share.

Think of it this way:

Instead of buying 50 different shares of Nifty companies one by one, you buy one ETF unit, and that single unit gives you exposure to all Nifty stocks together.

You don’t try to beat the market.

You simply move with the market.

That simplicity is the biggest strength of ETFs.

How ETFs Actually Work in Real Life

ETFs don’t depend on a star fund manager or daily decision-making. They are designed to copy, not compete.

Here’s how it works in simple terms:

A fund house creates an ETF that tracks an index like Nifty 50. The fund holds the same stocks in the same proportion as the index. These ETF units are listed on the stock exchange. Investors buy and sell them during market hours using a Demat account.

The price of an ETF changes throughout the day — just like a stock — based on demand, supply, and index movement.

There is no guessing game.

No stock-picking pressure.

No emotional decisions.

Why ETFs Are Becoming Popular in India

Earlier, ETFs were mostly used by institutions. But now retail investors are slowly realizing their value.

The biggest reasons are:

- Very low expense ratio

- No unnecessary churning

- Full transparency

- Predictable performance

- Perfect for long-term investing

In a time where even small cost differences can impact long-term returns, ETFs give investors a clear advantage.

Different Types of ETFs You’ll Find in India

ETFs are not limited to just stock indices.

Equity ETFs

These track stock market indices like Nifty 50, Sensex, Nifty Next 50, Bank Nifty, etc. They are ideal for long-term equity exposure.

Sector ETFs

These focus on specific sectors like banking, IT, pharma, PSU, or FMCG. They are more volatile and should be used carefully.

Gold ETFs

Gold ETFs track domestic gold prices and remove the hassle of storing physical gold.

Debt ETFs

These invest in government bonds or high-quality debt instruments and are suitable for conservative investors.

International ETFs

Some ETFs give exposure to global markets like the US stock market.

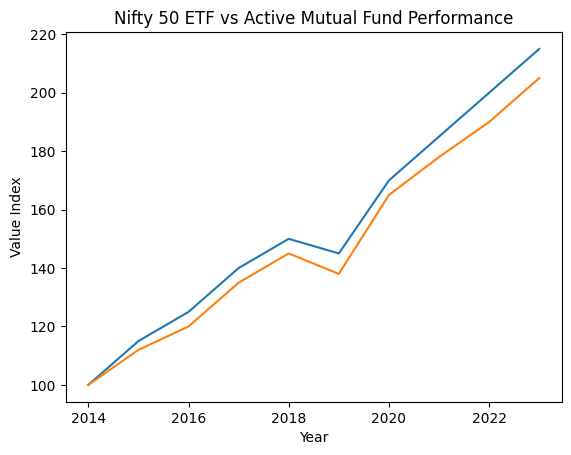

ETF vs Mutual Fund: The Real Difference

Many people ask whether ETFs are better than mutual funds. The honest answer is — they serve different types of investors.

Mutual funds are usually actively managed. ETFs are mostly passive.

ETFs are cheaper, more transparent, and predictable. Mutual funds rely on fund manager skill.

If you believe markets grow over time, ETFs make a lot of sense. If you believe someone can consistently beat the market, mutual funds may suit you better.

ETF vs Index Mutual Fund

Both track the same index, but ETFs trade on exchanges while index mutual funds are bought from AMC platforms.

ETFs usually have:

- Slightly lower costs

- Real-time pricing

- More flexibility

Index funds are easier for beginners without Demat accounts.

The Biggest Advantage of ETFs: Cost

Cost may look small today, but it makes a huge difference over 15–20 years.

A difference of even 1% in expense ratio can mean lakhs of rupees less in your final wealth.

ETFs remove unnecessary expenses and let compounding do its job quietly.

Risks You Should Know About ETFs

ETFs are not risk-free. They come with market risk.

When the market falls, ETFs fall too.

There is no protection from volatility.

Some ETFs also suffer from:

- Low liquidity

- Tracking error

- Emotional overtrading

But these risks are manageable if ETFs are used the right way — for the long term.

Who Should investment in ETFs?

ETFs are best suited for people who:

- Want long-term wealth creation

- Don’t want to track individual stocks

- Prefer discipline over speculation

- Believe in market growth

- Want low-cost investing

If you are patient, ETFs reward you.

Who Should Avoid ETFs?

ETFs may not suit:

- Short-term traders

- Investors looking for guaranteed returns

- People uncomfortable with market ups and downs

ETFs need time, not timing.

Can You Do SIP in ETFs?

Yes, you can.

While ETFs don’t have traditional SIPs like mutual funds, you can invest periodically using your broker or by manually buying units every month.

This helps:

- Reduce volatility impact

- Build discipline

- Avoid emotional decisions

ETFs and Long-Term Wealth Creation

ETFs work best when you stop watching daily market noise.

Over long periods, markets tend to move upward despite crashes, recessions, and panic phases. ETFs capture that growth without drama.

They are perfect for:

- Retirement planning

- Long-term financial goals

- Core portfolio building

How to Choose a Good ETF for investment

Don’t chase returns.

Focus on:

- Low tracking error

- Reasonable trading volume

- Low expense ratio

- Reputed fund house

ETF Investment Cycle

Think of ETF investing as a journey, not a one-day action. Most people lose money because they jump in and jump out without understanding this cycle.

Let’s walk through it step by step — slowly and clearly.

Step 1: Start With a Clear Reason to Invest

Every smart investment starts with a reason.

Before buying any ETF, ask yourself one simple question:

“Why am I investing this money?”

It could be:

- Building wealth for the long term

- Saving for retirement

- Protecting money from inflation

- Diversifying your portfolio

If you don’t know the reason, even the best ETF will disappoint you.

Step 2: Choose the ETF That Matches Your Goal

ETFs are not all the same. Each ETF is designed for a specific purpose.

For example:

- Index ETFs grow with the overall market

- Gold ETFs protect money during uncertainty

- Debt ETFs focus on stability and income

- International ETFs reduce dependence on one country

Choosing the wrong ETF for your goal is like wearing running shoes to a wedding — it just doesn’t fit.

Step 3: Set Up a Demat and Trading Account

Unlike mutual funds, ETFs are bought and sold like shares.

So you need:

- A Demat account

- A trading account

- A linked bank account

Once this is done, you’re ready to invest anytime during market hours.

Step 4: Understand What You Are Buying

This step is often ignored — and that’s a mistake.

Before investing, take a few minutes to check:

- Which index or asset the ETF follows

- How closely it tracks that index

- How much it charges every year (expense ratio)

You don’t need deep technical knowledge — just basic awareness.

Step 5: Decide How You Will investment (SIP or One-Time)

Now comes the practical decision.

If you invest regularly from salary or business income, ETF SIP works well.

If you have surplus money or market has corrected sharply, lump sum can also make sense.

There is no perfect method — consistency matters more than timing.

Step 6: Buy the ETF on the Stock Exchange

This part is simple.

You search the ETF symbol in your trading app, place the order, and the units are credited to your Demat account.

Prices change during the day, just like shares — but don’t overthink small price movements.

Step 7: Hold On, Even When Markets Are Uncomfortable

This is the most important stage of the ETF cycle.

Markets will:

- Fall suddenly

- Move sideways

- Create fear through news

Long-term ETF investors stay invested during these phases.

Why?

Because markets recover, and ETFs reflect that recovery.

Step 8: Review Occasionally, Not Obsessively

ETF investing is not trading.

You don’t need to check prices every day.

A review once or twice a year is enough to:

- See if the ETF still matches your goal

- Check if costs are under control

- Ensure your portfolio is balanced

Too much checking creates emotional decisions.

Step 9: Rebalance When Required

Over time, some investments grow faster than others.

Rebalancing simply means adjusting your investments to maintain the right risk level.

This keeps your portfolio stable and disciplined.

Step 10: Exit When the Goal Is Achieved

You invest for a reason — and one day that reason is fulfilled.

ETFs can be sold easily during market hours, and money comes directly to your bank.

A smart exit is as important as a smart entry.

The ETF Investment Cycle in One Simple Line

Plan → Choose ETF → Invest → Stay Patient → Review → Rebalance → Exit

Taxation of ETFs in India

Equity ETFs follow equity taxation rules.

If held for:

- Less than 1 year → Short-term capital gains tax

- More than 1 year → Long-term capital gains tax (after exemption limit)

Gold and debt ETFs follow different tax rules.

Always check current tax laws before investing.

Common ETF Mistakes Investors Make

- Trading ETFs daily like stocks

- Investing without understanding liquidity

- Overloading on sector ETFs

- Expecting quick profits

ETFs are not meant for excitement. They are meant for results.

Are ETFs Good for Beginners?

Yes, if beginners understand one thing clearly:

ETFs don’t make you rich overnight.

They make you wealthy slowly and steadily.

If you can accept this truth, ETFs are one of the best tools available.

Final Thoughts: Should You Invest in ETFs?

ETFs are not magic.

They don’t promise miracles.

ETF investing is not about predicting the market.

Discipline

Patience

Low cost

Long-term thinking

But they offer something far more valuable — clarity, discipline, and efficiency.

For investors who want a clean, low-cost, long-term approach, ETFs deserve a serious place in the portfolio.

Disclaimer

The information provided on TrendingAdda.in is for educational and informational purposes only and should not be considered as financial, investment, legal, or tax advice. Exchange Traded Funds (ETFs) and other market-linked investments are subject to market risks, including possible loss of capital.

Past performance of ETFs or any other financial instruments does not guarantee future returns. Market conditions, economic factors, and regulatory changes may impact investment performance. Readers are strongly advised to conduct their own independent research and consult with a SEBI-registered financial advisor before making any investment decisions.

TrendingAdda.in and its authors do not accept any responsibility or liability for any financial loss, damage, or decisions taken based on the information provided on this website. All investments are made at the reader’s own risk and discretion.

How is an ETF different from a mutual fund?

The main difference is how they are bought and sold. Mutual funds are purchased directly from the fund house at end-of-day NAV, while ETFs are traded on the stock exchange in real time. ETFs usually have lower expenses and offer more transparency than mutual funds.

Do ETFs give guaranteed returns?

No, ETFs do not provide guaranteed returns. Their performance depends on the underlying index or asset they track. However, long-term ETFs linked to strong markets have historically delivered stable and competitive returns over time.

Can I investment in ETFs through SIP?

Yes, many brokers allow SIP-style investing in ETFs. You can buy ETF units regularly at fixed intervals, similar to a mutual fund SIP. This helps reduce market timing risk and builds investment discipline.

What is the minimum amount required to invest in an ETF?

You only need enough money to buy one unit of an ETF. The price depends on the ETF, but many ETFs are available at affordable prices, making them accessible to small investors.

Are ETFs good for long-term investment?

ETFs are excellent for long-term investing. Due to low costs, diversification, and market-linked growth, ETFs are widely used for retirement planning, wealth creation, and inflation protection

How are ETFs taxed in India?

ETF taxation depends on the type of ETF:

Equity ETFs follow equity mutual fund tax rules

Debt ETFs follow debt taxation rules

Gold ETFs are taxed like non-equity funds

Can ETFs be sold anytime?

Yes, ETFs can be bought or sold anytime during stock market hours. This provides high liquidity and flexibility compared to traditional mutual funds.

What are the risks involved in ETFs?

ETFs carry market risk, tracking error risk, and liquidity risk in some cases. However, these risks are generally lower in well-known and high-volume ETFs. Choosing the right ETF and holding it long-term helps reduce risk.

Do ETFs pay dividends?

Some ETFs pay dividends if the underlying assets generate income. Others reinvest the income to increase the ETF’s value. The dividend policy depends on the specific ETF.

Is a Demat account mandatory for ETF investment?

Yes, a Demat and trading account is mandatory because ETFs are traded on stock exchanges just like shares.

Which ETF is best for beginners in India?

Broad market ETFs like Nifty 50 ETFs, Sensex ETFs, or Nifty Next 50 ETFs are commonly preferred by beginners due to their stability, diversification, and simplicity.

Can I lose money in ETFs?

Yes, like any market-linked investment, ETFs can go down in value during market downturns. However, long-term investors who stay invested through market cycles usually recover and grow their investments.

Are ETFs suitable for passive investors?

Absolutely. ETFs are designed for passive investing. If you don’t want to actively pick stocks or monitor markets daily, ETFs are one of the best investment options available.