Credit Card Mistakes That Can Ruin Your Financial Life

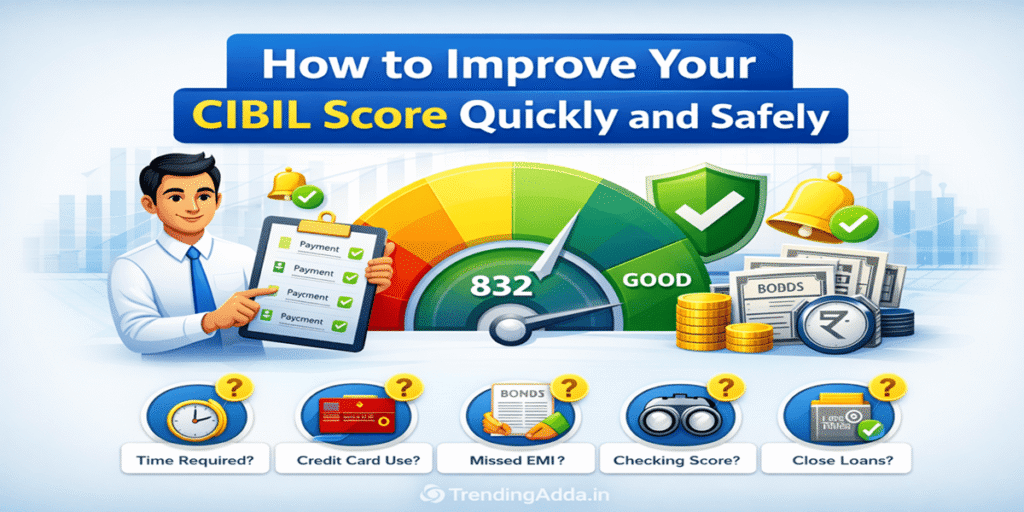

Credit cards are a convenient financial tool that can help you build credit, earn rewards, and manage expenses. However, misusing them can quickly lead to debt, financial stress, and a damaged credit score. Many people make simple mistakes with their credit cards without realizing the long-term consequences. 1. Missing Payments or Paying Late Late payments are one of the most common mistakes that can damage your financial life. Why it’s harmful: Example:Ravi missed his credit card payment once. His ₹10,000 balance attracted ₹500 in late fees, and interest started accruing immediately. Within three months, his debt increased to ₹11,200. Tips to avoid: 2. Paying Only the Minimum Amount Paying just the minimum balance might seem enough, but it can trap you in debt. Why it’s harmful: Example:If you owe ₹50,000 at 24% interest and pay only ₹2,000 per month, it could take over 3 years to clear the debt, costing more than ₹20,000 in interest. Tips: 3. Overspending Beyond Your Means Credit cards can make you feel richer than you are, leading to overspending. Why it’s harmful: Example:Sneha earned ₹40,000 per month but spent ₹80,000 on her credit cards. She could not repay the debt, and interest continued to grow, making it unmanageable. Tips: 4. Ignoring Your Credit Card Statements Many people never review their credit card statements. This can be very risky. Why it’s harmful: Example:Amit never checked his statements. A fraudulent transaction of ₹2,000 went unnoticed for 2 months, causing him extra stress and delayed refunds. Tips: 5. Opening Too Many Credit Cards at Once Having multiple credit cards might seem advantageous, but it comes with risks. Why it’s harmful: Tips: 6. Using Credit Cards for Cash Advances Cash advances from credit cards are very costly and should be avoided. Why it’s harmful: Example:Rahul withdrew ₹10,000 from his credit card as a cash advance. The bank charged ₹300 fee and started interest immediately. After one month, he owed ₹10,500. Tips: 7. Neglecting Your Credit Score Credit cards affect your credit score significantly. Mismanagement can harm your financial credibility. Why it’s harmful: Tips: 8. Ignoring Terms and Conditions Not reading the fine print is another mistake many make. Why it’s harmful: Tips: How to Use Credit Cards Wisely Real-Life Case Studies Case Study 1: OverspendingAnita had 4 credit cards with a total limit of ₹2,00,000. She spent ₹1,50,000 in one month and paid only minimum balances. Her debt increased to ₹1,90,000 due to interest and penalties, and she had to negotiate repayment with her bank. Case Study 2: Ignoring StatementsRaj never checked his statements. A fraudulent online purchase of ₹25,000 went unnoticed for 3 months. His bank initially declined a refund because it was reported late. These examples highlight the real consequences of careless credit card usage. Conclusion Credit cards are a powerful tool for financial management, but misuse can ruin your financial life. Avoid mistakes like late payments, overspending, cash advances, ignoring statements, and neglecting your credit score. By using credit responsibly, you can build credit, earn rewards, and secure financial stability for the future. Disclaimer The information provided in this article is for educational and informational purposes only. It is not intended as financial, legal, or professional advice. Always consult with a qualified financial advisor or your bank before making decisions regarding credit cards, loans, or other financial products. TrendingAdda.in is not responsible for any financial losses or consequences arising from the use of this information. Frequently Asked Questions (FAQs)