Introduction — Long-Term Wealth with SIP

Investing for the long term is one of the most reliable ways to build wealth and achieve financial goals like retirement, children’s education, or house purchase. Among various investment methods available in India, SIP (Systematic Investment Plan) stands out as a powerful, disciplined, and flexible option—especially for middle-class investors.

A SIP allows you to invest small amounts regularly in mutual funds, harnessing the power of compounding and rupee cost averaging to grow your wealth over time.

In this article, we’ll explore the best SIP investment plans for long-term wealth creation in India, the reasons they work, and how you can choose the right ones based on goals and risk appetite.

What Is SIP & Why Is It Ideal for Long-Term Investment?

🔹 What Is SIP?

SIP (Systematic Investment Plan) is a method of investing a fixed amount at regular intervals (typically monthly or quarterly) into mutual fund schemes. It’s not a mutual fund itself, but a method of investing.

🔹 Why SIP Works for Long-Term Goals

1. Rupee Cost Averaging

By investing regularly, you buy more units when prices are low and fewer units when prices are high—reducing the average cost per unit.

2. Compounding Magic

Money grows exponentially over time thanks to reinvestment of returns.

3. Discipline and Ease

Auto-debit setup ensures investing is automatic and consistent without emotional delays.

4. Small Starts Work

Even ₹500–₹1,000 per month can grow into significant wealth with time.

How Long-Term SIP Builds Wealth (Quick Example)

| Monthly SIP | Period | Estimated Returns (12% p.a.) | Maturity Value |

|---|---|---|---|

| ₹2,000 | 10 years | 12% | ~₹4.2 lakh |

| ₹5,000 | 15 years | 12% | ~₹25 lakh |

| ₹10,000 | 20 years | 12% | ~₹94 lakh |

(Approx. figures for illustration based on compounding)

Top SIP Investment Plans for Long-Term Wealth

Below are some categories of SIP plans that are proven and commonly recommended by financial experts for long-term investors in India.

🟢 1. Large Cap Equity Funds (Core Foundation)

Best For: Beginner to conservative long-term investors

Why: Large cap funds invest in established, high-market-cap companies which show stable growth and moderate risk.

👉 Good option when you want growth but limited volatility.

Examples (Popular Funds)

- SBI Bluechip Fund

- ICICI Prudential Bluechip Fund

- Axis Bluechip Fund

🟠 2. Flexi Cap Funds (Flexible Growth)

Best For: Investors wanting broad exposure + smart allocation

Why: These funds can change equity allocation across large, mid, and small caps based on market conditions.

👉 Flexi cap funds are often considered “all-weather” funds.

Examples

- Parag Parikh Flexi Cap Fund

- Kotak Flexi Cap Fund

- Axis Flexi Cap Fund

🔵 3. Mid Cap Equity Funds (Higher Growth Potential)

Best For: Investors with higher risk tolerance

Why: Mid-cap companies may grow faster than large caps over long durations but are slightly riskier.

👉 Only suitable for 7+ year timeframes.

Examples

- HDFC Mid-Cap Opportunities Fund

- DSP Mid Cap Fund

- Nippon India Mid Cap Fund

🔴 4. Multi Cap Funds (Balanced Growth)

Best For: Investors wanting exposure to multiple segments

Why: Similar to flexi caps but always invests across large + mid + small caps.

Examples

- Kotak Standard Multicap Fund

- UTI Multi Cap Fund

- Canara Robeco Multi Cap Fund

🟡 5. ELSS (Tax-Saving + Long-Term Growth)

Best For: Tax savers

Why: ELSS provides tax benefit under Section 80C along with equity exposure. Lock-in of 3 years also helps discipline.

Examples

- Axis Long Term Equity Fund

- Mirae Asset Tax Saver Fund

- Aditya Birla SL Tax Relief ’96

🟣 6. Index Funds (Low Cost + Passive)

Best For: Passive investors

Why: Tracks a market index (like Nifty 50) with low expense ratio and steady long-term growth.

Examples

- UTI Nifty Index Fund

- HDFC Index Fund – Nifty 50 Plan

- ICICI Prudential Nifty Next 50 Index

🔷 7. Target Maturity or Goal-Based SIP Funds

Best For: Specific financial goals

Why: Some fund houses offer SIPs linked to goals like retirement, child education or marriage with asset allocation models.

Examples

- Goal-based funds from HDFC / ICICI / SBI with target age models

How to Choose the Right SIP Investment Plan

1. Define Your Goal

- Retirement? → Equity-oriented SIPs

- House Down Payment? → Conservative Mix

- Child Education? → Balanced SIP

2. Risk Appetite

- Low → Large cap / Index

- Medium → Multi/Flexi cap

- High → Mid/Small cap

3. Time Horizon

- ≥ 7 years → Equity SIP recommended

- < 7 years → Conservative or debt hybrid SIP

4. Expense Ratio

Select funds with lower expense ratios as they eat into returns.

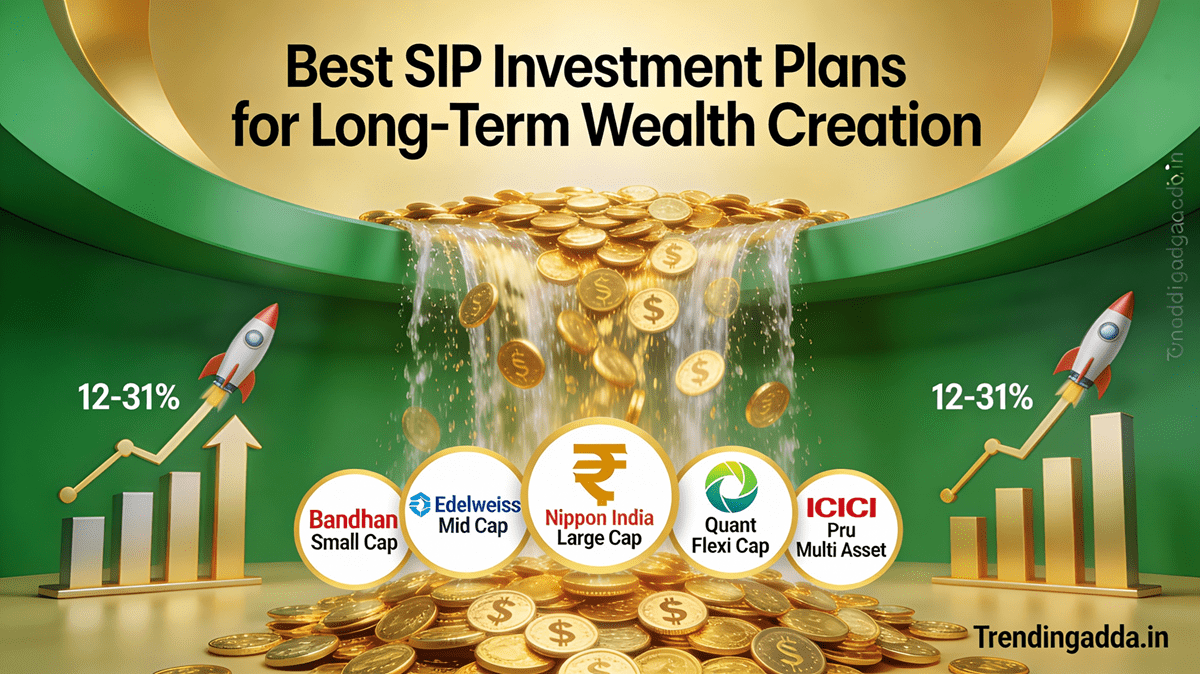

Long-term wealth creation (10+ years) ke liye best SIP plans equity-oriented funds hain jo historically 12–18% returns de chuke hain, rupee cost averaging ke saath market volatility beat karte hain.

Top 5 SIP Plans for 2026 (10-yr SIP returns based)

| Rank | Fund Name | Category | 10-Yr SIP Return | AUM (Cr) | Min SIP |

|---|---|---|---|---|---|

| 1 | Bandhan Small Cap Fund | Small Cap | 31.22% | ₹15,738 | ₹100 |

| 2 | Edelweiss Mid Cap Fund | Mid Cap | 29.53% | ₹11,731 | ₹100 |

| 3 | Nippon India Large Cap Fund | Large Cap | 25.54% | ₹30,000+ | ₹100 |

| 4 | Quant Flexi Cap Fund | Flexi Cap | 22–25% | Large | ₹500 |

| 5 | ICICI Pru Multi Asset Fund | Hybrid | 18–25% | ₹30,802 | ₹100 |

Example: ₹5,000/month SIP in Bandhan Small Cap @31% → 10 yrs me ₹15–20L ban sakta hai (past performance based).

Category-wise recommendations

Conservative (Low-Moderate Risk):

Growth-oriented (High Risk):

Balanced:

Investment strategy

- ₹50k/month income: 40% large/flexi, 30% mid, 20% small, 10% debt hybrid.

- Start small (₹1k–5k SIP), top-up 10–20% yearly with salary hikes.

- Horizon 7+ years rakho; review annually, rebalance if needed.

SIP Calculator Table: How Much Your SIP Can Grow

Assumptions for Table:

- Monthly SIP: ₹5,000

- Expected Annual Return: 12% (Equity Mutual Fund Average)

- Duration: 5, 10, 15, 20 years

- Compounding: Annual

| Duration | Total Invested (₹) | Estimated Value (₹) | Approx Gain (₹) |

|---|---|---|---|

| 5 Years | 3,00,000 | 4,33,000 | 1,33,000 |

| 10 Years | 6,00,000 | 14,80,000 | 8,80,000 |

| 15 Years | 9,00,000 | 30,00,000 | 21,00,000 |

| 20 Years | 12,00,000 | 61,00,000 | 49,00,000 |

Explanation:

- Investing ₹5,000 per month consistently over 20 years can grow into over ₹60 lakh.

- Compounding and rupee cost averaging work even if markets fluctuate.

Optional Table: Different Monthly SIP Amounts (15 Years)

| Monthly SIP (₹) | Total Invested (₹) | Estimated Value (₹) | Gain (₹) |

|---|---|---|---|

| 2,000 | 3,60,000 | 12,00,000 | 8,40,000 |

| 5,000 | 9,00,000 | 30,00,000 | 21,00,000 |

| 10,000 | 18,00,000 | 60,00,000 | 42,00,000 |

How to Start a SIP investment (Step-by-Step)

- Open an account with AMC / broker / app

(Zerodha, Groww, Kuvera, ET Money, CAMS, MFU) - Complete KYC verification

(if not already done) - Select the mutual fund plan

(based on risk & goal) - Choose SIP amount & date

(₹500 minimum usually) - Set auto debit (NACH)

(money gets deducted automatically) - Monitor performance annually

(don’t react monthly)

SIP Mistakes to Avoid

❌ Investing without a plan

❌ Frequent fund switching

❌ Chasing past returns

❌ Selling SIP during market dips

❌ Ignoring asset allocation

SIP vs RD (Bonus Section)

| Feature | SIP | RD |

|---|---|---|

| Risk | Moderate–High | Very Low |

| Returns | 10–15%+ (long-term) | 5–7% |

| Flexibility | High | Medium |

| Inflation Protection | Good | Poor |

| Tax Efficiency | Better | Interest taxed |

👉 For long-term goals, SIP > RD generally.

Conclusion

SIP is one of the most powerful tools for long-term wealth creation in India. Starting small, staying consistent, and choosing the right type of mutual fund SIP based on goals and risk tolerance can lead to significant financial growth over time.

Whether your goal is retirement, a child’s future, or building wealth, these best SIP plans offer reliable pathways for disciplined and effective investing.

Disclaimer:

The information provided in this article is for educational and informational purposes only. It does not constitute financial, investment, or legal advice. All investments carry risk, and past performance does not guarantee future returns. Readers should make investment decisions based on personal goals, risk tolerance, and professional consultation. TrendingAdda.in is not responsible for any financial losses.

What is the best SIP investment plan in India?

The best SIP plan depends on your goals and risk appetite. For beginners, large-cap funds are safe. Flexi-cap and mid-cap funds offer higher returns for long-term investors.

How much should I invest in a SIP per month?

You can start with as little as ₹500–₹1,000 per month. For significant wealth creation, investing ₹5,000–₹10,000 per month consistently over 10–20 years is recommended.

Can SIPs beat inflation?

Yes. Equity-based SIPs have historically returned 10–15% annually, which typically beats inflation over the long term.

What is the ideal time horizon for SIP investment?

For meaningful wealth creation, a SIP should be held for 7–15+ years. Shorter periods may not fully benefit from compounding.

Can I combine multiple SIPs?

Yes. Diversifying across large-cap, flexi-cap, mid-cap, and index funds reduces risk and improves long-term returns.