Bad investing rarely fails because of markets.

It fails because of unrealistic assumptions.

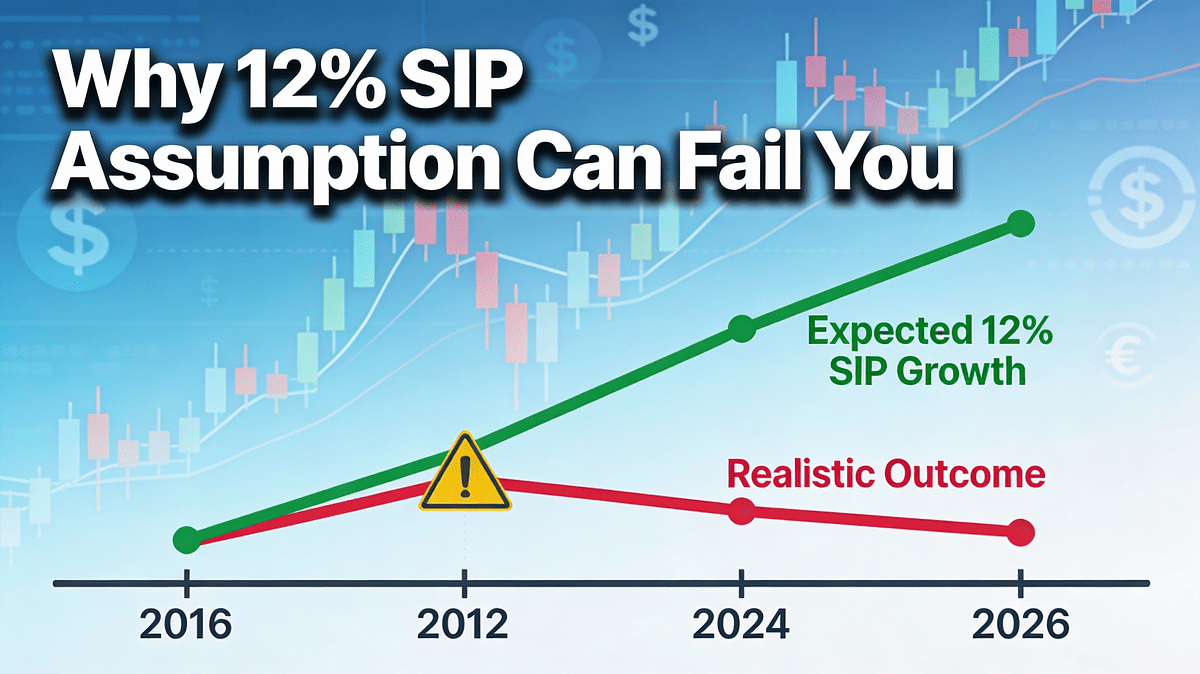

For more than a decade, 12% annual return has become the unofficial default assumption for SIP and mutual fund investing in India. It appears everywhere — SIP calculators, retirement illustrations, YouTube thumbnails, distributor presentations, and financial planning apps.

The number looks harmless. In fact, it looks conservative to many investors.

But this single assumption has silently caused:

- chronic under-saving

- false confidence

- and large goal shortfalls, especially for retirement and children’s education

This article explains — in depth — why assuming a fixed 12% SIP return is one of the most dangerous planning mistakes long-term investors make, and how to replace it with a smarter framework for 2026 and beyond.

1. The Origin of the 12% Myth

The 12% figure didn’t come from fraud or manipulation. It came from simplification.

Historically:

- Indian equity markets have delivered 11–14% CAGR over very long periods

- Mutual fund illustrations needed a single number

- Advisors needed a sellable story

- Calculators needed clean math

So 12% became the default.

The Problem

Markets do not deliver returns in straight lines, and investors do not behave like spreadsheets.

Averages hide:

- volatility

- long flat periods

- deep drawdowns

- and most importantly — human behavior

Using a single fixed return number for a 20–30 year plan is mathematically convenient but financially reckless.

2. SIP Returns Are Not CAGR — They Are XIRR

Most investors misunderstand what “12% return” actually means.

CAGR vs XIRR

- CAGR assumes one-time investment

- SIP returns are measured using XIRR, which depends on:

- timing of cash flows

- market levels at each contribution

- sequence of gains and losses

Two investors investing the same amount monthly can end up with very different outcomes, even if the market’s long-term CAGR is identical.

Why This Matters

SIP returns are path-dependent, not average-dependent.

This single fact alone breaks the 12% assumption.

3. Sequence of Returns Risk

Sequence of returns risk means:

The order in which returns occur matters more than the average return.

Example Scenario

Investor A:

- Strong returns in early years

- Weak returns later

Investor B:

- Weak returns in early years

- Strong returns later

Both markets deliver the same long-term CAGR.

Yet:

- Investor A ends up with significantly higher corpus

- Investor B feels SIP “didn’t work”

Why?

Because money invested earlier compounds longer.

Most SIP calculators completely ignore sequence risk and assume smooth compounding — which never happens in reality.

4. The Valuation Problem Nobody Talks About

SIP is often marketed as “market timing proof”.

This is misleading.

SIP Does NOT Protect You From:

- starting investments in overvalued markets

- long periods of multiple contraction

- structurally low return decades

If you begin a 20-year SIP during high valuation phases, your first 8–10 years may generate sub-par returns, permanently lowering final outcomes.

History shows:

- High starting valuations → lower future returns

- Low starting valuations → higher future returns

A flat 12% assumption ignores valuation cycles completely.

5. The Behavioral Gap: Real Investors vs Ideal Investors

This is where most planning models collapse.

SIP calculators assume:

- uninterrupted monthly investments

- no panic during crashes

- no portfolio changes

- no withdrawals

Real investors:

- stop SIPs during bear markets

- redeem at market lows

- switch funds based on recent performance

- chase themes and narratives

This gap between market returns and investor returns is called the behavioral gap.

Studies globally show:

- Investors earn 2–4% less than fund returns over long periods

- SIP discipline breaks exactly when discipline is needed most

That turns a “12% expected plan” into an 8–9% lived reality.

6. Inflation Turns 12% Into an Illusion

Nominal returns are meaningless without context.

If:

- SIP return = 12%

- Inflation = 5–6%

Then:

- Real return = ~6–7%

Now add:

- lifestyle inflation

- higher healthcare costs

- education inflation

- taxes on gains

Your actual purchasing power growth may be closer to 4–5%.

Yet most retirement plans are built assuming:

- expenses grow slower than investments (rarely true)

This mismatch creates devastating surprises later.

7. Taxation and Expense Drag

Even well-performing SIPs lose returns to friction.

Return Leakages:

- Expense ratios

- Exit loads

- Capital gains tax

- Portfolio churn

Over 25–30 years, these leakages compound negatively.

A 12% gross return can easily become 9–10% net, even before accounting for behavior and inflation.

Planning at 12% without accounting for friction is optimism bias.

8. Retirement Planning: Where the Damage Is Maximum

Retirement planning magnifies all errors.

Typical Scenario

- Monthly SIP: ₹25,000

- Time horizon: 25 years

- Assumed return: 12%

- Expected corpus: ~₹4.2 crore

Now adjust assumptions:

- Actual return: 9%

- Real return (post inflation): ~4–5%

Final purchasing power drops by 40–50%.

At age 55 or 60:

- SIP extension is limited

- risk capacity is lower

- recovery time is gone

This is where bad assumptions become irreversible.

9. Why the Financial Industry Still Uses 12%

The reason is simple: sales psychology.

Higher assumed returns:

- reduce required monthly investment (on paper)

- make goals look achievable

- increase conversions

Lower assumed returns:

- force higher savings

- create discomfort

- reduce immediate sales

The industry optimizes for entry, not long-term outcome.

Responsibility lies with the investor to question assumptions.

10. When 12% Can Actually Happen

To be fair, 12% is not impossible.

It can happen if:

- valuations remain reasonable

- investor stays disciplined

- portfolio is well diversified

- step-ups are consistent

- no major behavioral mistakes occur

But planning your life on best-case scenarios is not intelligence — it’s gambling.

11. A Smarter Return Assumption Framework

Instead of one number, use ranges.

| Scenario | Assumed Return |

|---|---|

| Conservative | 7–8% |

| Realistic | 8.5–10% |

| Optimistic | 11–12% |

Rule

Plan at conservative returns.

Invest for optimistic returns.

This creates margin of safety.

12. The Correct Way to Use SIP in Long-Term Planning

SIP is not a strategy. It is a tool.

The real strategy includes:

- asset allocation

- valuation awareness

- rebalancing

- goal-based derisking

Smart SIP Framework

- Use SIP for discipline, not return guarantees

- Increase SIP with income growth

- Rebalance every 2–3 years

- Reduce equity exposure near goal maturity

- Never plan critical goals at peak optimism

13. Who Should Never Use 12% Assumptions

- Late starters (age 40+)

- Single income families

- Goal-critical investors

- Low risk tolerance individuals

- Anyone uncomfortable with 30–40% drawdowns

For these investors, 8–9% planning is responsible.

14. Psychological Cost of Over-Optimism

When reality underperforms expectations:

- investors lose trust

- discipline breaks

- SIPs stop

- blame shifts to products

Most “SIP failures” are expectation failures, not product failures.

15. Final Investor Checklist

Before assuming any return, ask:

- What if returns are lower for a decade?

- Can I increase investments if needed?

- Do I understand drawdowns?

- Have I planned for inflation honestly?

- Is my plan survivable in worst cases?

If the answer is no, the return assumption is wrong.

Conclusion: Assumptions Decide Outcomes

Markets don’t owe you 12%.

SIP doesn’t promise compounding.

And calculators don’t live your life.

Wealth is built by conservative planning, disciplined execution, and realistic expectations.

Disclaimer

The content provided on this blog is for informational and educational purposes only and does not constitute financial advice. Investments in mutual funds, SIPs, stocks, or any other financial instruments involve risk, including the potential loss of principal. Past performance is not indicative of future results. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions. The author and the website are not responsible for any financial losses or damages that may occur as a result of using the information presented here.

Is 12% SIP return guaranteed?

No. There are no guarantees in equity investing.

What return should I assume for SIP planning?

8–10% is realistic for long-term goal planning.

Is SIP still worth doing?

Yes — as a discipline tool, not a return promise.